The BMW Group ended 2019 with an overall substantial decrease in net profit by -28.9% compared to 2018, with profitability directly impacted due to high investment costs in the push for the massive electrification of the model portfolio.

Let’s begin with the good news. In 2019, the entire BMW Group managed to sell more car and motorcycles worldwide by up to +2.44%. Exactly 2,713,529 vehicles have been sold worldwide last year, splitted as follows: 2,538,367 units on the automotive segment (vs. 2,483,292 in 2018, related to an YoY increase of +2.2%) and 175,162 units in on the motorcycle segment (as opposed 165,566 in 2018, which stands for an YoY increase of +5.8%).

The automotive division of the BMW Group experienced an overall business and sales growth last year vs. Y18, with mostly all brand facing a successful upwards path. On a standalone view, BMW sold 2,185,793 vehicles in 2019 (+3.3% vs. 2018), while Rolls-Royce managed to break to 5K barrier and posted a consistent increase of +21.6% vs. 2018 to 5,100 units sold last year.

Only the MINI was faced with a significant contraction in sales, suffering an overall decrease of -4.6% compared to 2018, having sold 347,474 units in 2019.

The BMW Motorrad went through another successful year in 2019 in terms of sale, as it managed to boost its overall sale by an important +5.8%. It is crucial to highlight the fact the BMW Group as a whole ended 2019 with slightly smaller workforce than at YE18 (year end 2018).

Former GM electrification expert will join BMW Management Board

133,778 people were employed by the automotive conglomerate at YE19, which corresponds to a YoY decrease of the labour force by around -0.7% (2018: 134,682).

Now, let’s continue with the more complex part. The BMW Group and all its component companies are going through a massive business reshape and reorientation. This involves high costs for research and investment, which for the time being, directly impact profitability and overall financial performance.

Only the R&D expenses performed in 2019 by the BMW Group amounted to € 5,952 million, an increase of +11.9% compared to Y18.

Significant increase in investment expenses regarding property, plant, equipment and other intangible assets, as CAPEX (capital expenditure) performed throughout last year totaled € 5,650 million (+12.3% YoY increase vs. 2018). This CAPEX constantly bit from profitability margins and diminished the overall operational and net results.

Yet, you have to take into consideration that the costly push to electrification and reshaping an entire brand will be valuable in 2-3 years, when the impact of the high upfront expenditures will be seen in the growth of operational efficiency and profitability.

In terms of profit margins, the earnings before taxes (EBT or the profit before paying your profit-related taxes) has decreased -2.3% YoY for the automotive division, while the motorcycle division spawned a mere growth of 0.1% vs. Y18. Overall, the EBT margin achieved by BMW Group has diminished 6.8% (vs. 9.9% in 2018).

Additionally, even though total revenues were higher in 2019 than on the previous exercise by +7.6%, taking into account the high level of CAPEX performed, together with the load of depreciation, amortizing and other expense-related items, it resulted in an EBIT that fell no less than -17% vs. 2018. Subsequently, these triggered an YoY fall in EBIT of no less than -26.1%

The income taxes softened a bit the hard landing (smaller in size than in 2018, corresponding to the negative performance), so the net profit marked a substantial decrease settling up to € 5,022 million for EoY19 (-28.9% short of the 2018 achieved net profit).

Following the official announcement of the Y19 financial results, a dividend € 2.50 per share of common stock will be proposed (for all divisions). This is slightly smaller than the Y18 level, as the Group-view earnings per shade indicator (EPS) is dropping to € 7.47 (almost -30% impact in shareholder profitability).

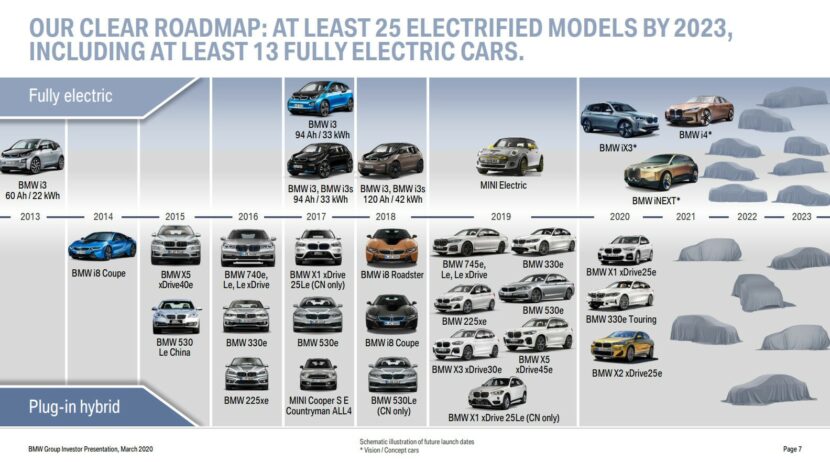

For the next years, the BMW Group plans a massive electrification of the whole range of models. No less than 25 new models are expected to bow till 2023. The main stars of the show are the iX3 electric SAV expected in 2020, the iNEXT (iX) flagship and the i4 Gran Coupe, both coming in 2021. Several other models, like a 5 and 7 Series electric will also arrive by 2023.